Invest Smart, Grow Securely: Your Guide to Mutual Funds in India

Unlock the potential of the Indian market with diversified mutual fund investments tailored to your financial goals.

Our Consultation Process

Your Journey to Financial Success

Offering Elementor timeline widget that supports a box with colorful background.

Initial Meeting

Understand client’s needs, expectations, and introduce our services and approach.

1

Data Collection

Gather financial details, goals, risk appetite, and current investment information.

2

Goal Setting

Define clear, time-bound financial objectives tailored to the client’s life plans.

3

Risk Assessment

Evaluate comfort with market fluctuations and capacity for potential losses.

4

Financial Analysis

Analyze income, expenses, assets, liabilities, and existing investment performance.

5

Strategy Discussion

Discuss possible investment strategies and clarify any doubts or preferences.

6

Plan Drafting

Prepare a preliminary investment plan aligned with goals and risk profile.

7

Client Feedback

Review the draft plan with the client and incorporate their feedback.

8

Final Recommendations

Present the refined investment recommendations for client approval and next steps.

9

Advantages of Mutual Fund Investing

Mutual funds offer a smart way to grow your wealth, combining professional expertise, diversification, and easy access to your money for every investor.

Professional Management

Expert fund managers handle your investments, leveraging market knowledge to optimize returns and manage risk.

Diversification

Spread risk across various securities and asset classes, reducing impact from any single investment's poor performance.

Liquidity

Easily redeem units (especially in open-ended funds) with proceeds typically credited quickly.

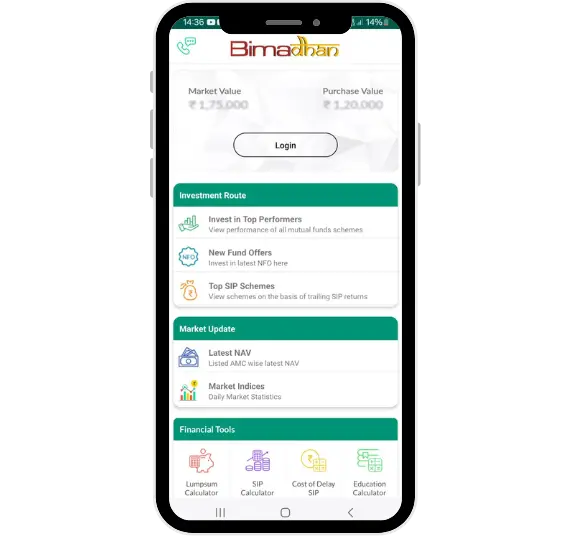

Download our

App from the store

Keep your investments in control and track all your portfolios easily in one convenient app.

Download the above app and contact us for a complimentary access to the most powerful app in India! Click the below button.

Discover how Bimadhan simplifies your journey to financial security by offering expert guidance, personalized solutions, and dedicated support for all your insurance, loan, and investment needs.

Quick Link

- Home

- About Us

- Services

- Blogs

- Privacy Policy

- Terms of Service

- Frequently Asked Questions

Contact

Phone

+919871050135 +919910887735 +919582315794 +919804040460

Address

2252-C, Raja Park Delhi-110034, India